Minimum wage refers to a fixed hourly amount imposed by the US Department of Labor. Living wage differs from minimum wage in that companies are not required to follow legal rules as they would if they provided employees minimum pay. A prevailing wage is a form of wage utilized in government contracts between government agencies and outside firms. Severance pay is a form of salary paid by employers to employees who must be let go. When an employee works more than 40 hours in a week, their overtime compensation is generally twice that amount. Overtime pay is given to employees who work more than 40 hours each week.

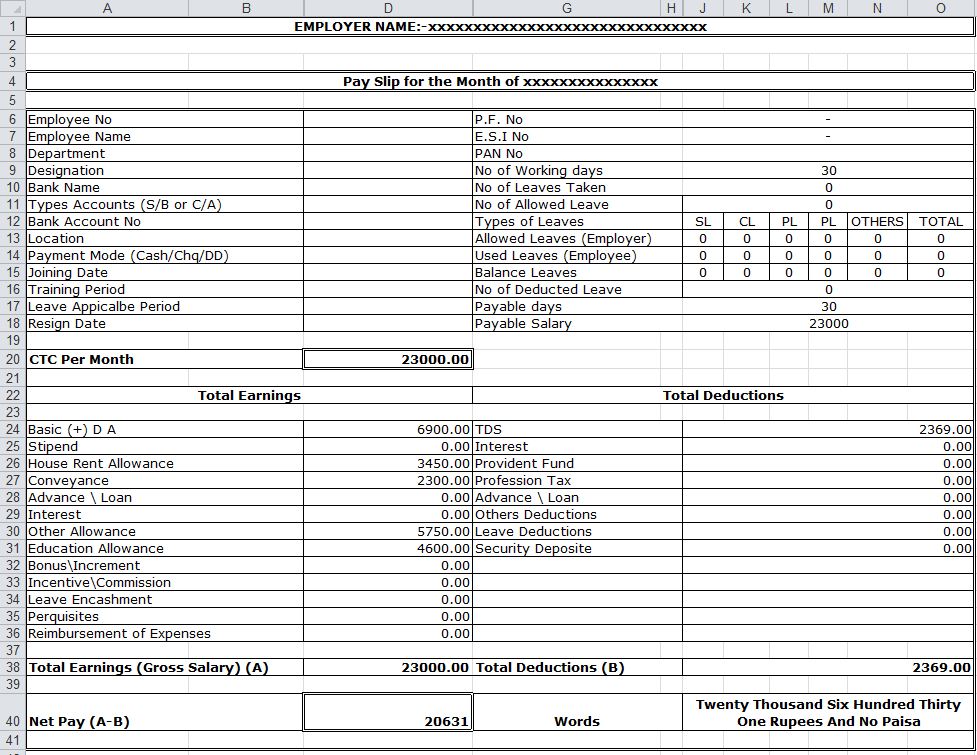

It considers things like the cost of living in a specific location and the usual salary for a given job. By “fair wage,” we mean an amount that businesses can afford to pay their workers. In addition to hourly or salary income, employers provide commission. Commissions are generally given to salespeople by their employers. This is a popular form of remuneration for part-time and sometimes full-time work. They are a form of compensation in which employees are paid by the hour. They generally distribute payments throughout the course of the year to equal the annual amount agreed to in employment contracts. Salaries are fixed sums of money that companies pay to their workers on a yearly basis. It’s critical to be aware of the various forms of pay since doing so can aid you in making critical career decisions. Total Salary = Weekly Pay x Work Weeks per Year Hourly to salary – types of wages Total Weekly Pay = Regular Weekly Pay + Overtime Weekly Pay Those hours would be 15 if you worked 55 hours a week. Overtime hours are hours worked more than 40 per week. Overtime Weekly Pay = Hourly Wage x 1.5 x Overtime Hours Regular Weekly Pay = Hourly Wage x Hours Worked Use the following formulas to calculate salary from hourly wage: So, if a person makes $40,000 per year working 40 hours per week, their hourly wage is around $19.23. You may also calculate an employee’s hourly compensation by dividing their yearly salary by the amount of hours worked in a year.Ī full-time employee works 2,080 hours a year based on a standard work week of 40 hours (40 hours a week x 52 weeks a year). Do you want to know what your yearly income is? Trying to compare different jobs? How do I compute an employee’s hourly rate based on annual salary? Simply input your hourly rate and the amount of hours you want to work each week. Just like a bi-weekly pay frequency, a weekly pay frequency is commonly used to pay hourly employees.The hourly to salary or hourly rate calculator can assist you in determining what that wage is. Paychecks are issued once a week, usually for hours worked the week prior.

0 kommentar(er)

0 kommentar(er)